▼ ADB to provide loan to improve rural road connectivity [11-30-17]

Multilateral funding agency Asian Development Bank (ADB) on 29th Nov, 2017 said it will provide a $500 million loan to improve rural road connectivity in five states, including Assam and West Bengal.

The board of directors of ADB has approved the multi-tranche financing facility (MFF) for the 'Second Rural Connectivity Investment Programme' to improve rural roads in five states of India, ADB said in a statement.

Under this project, ADB will invest to construct and upgrade over 12,000 kilometre rural roads in Assam, Madhya Pradesh, Chhattisgarh, Odisha and West Bengal. It will also support state governments to improve rural road maintenance and safety.

ADB is building on the success of previous assistance for rural roads in India. The agency will work closely with the government to improve connectivity for the rural people to access markets, health centres, education and other opportunities.

In the first tranche, ADB is expected to invest USD 250 million in December for construction of initial 6,254 km all weather rural roads in these states. While the second tranche of the loan of same amount is expected to come by the third quarter of 2019.

This leg of the ADB loan assistance for rural roads builds on the first 'Rural Connectivity Investment Programme in 2012' financing USD 800 million MFF to add about 9,000 km all-weather rural roads in these five states.

Apart from this MFF, the Manila-headquartered agency will provide a USD 500,000 technical assistance (TA) grant from its Technical Assistance Special Fund to strengthen sustainability of rural road assets, disaster resilience and innovation in rural road development.

The TA is due for completion in December 2021, with the investment programme expected to be completed by the end of 2023, ADB said.

Rural roads comprise nearly 80 per cent of India's overall paved road network connecting them to major district roads, state roads and national highways. Multilateral funding agency Asian Development Bank (ADB) on 29th Nov, 2017 said it will provide a $500 million loan to improve rural road connectivity in five states, including Assam and West Bengal.

The board of directors of ADB has approved the multi-tranche financing facility (MFF) for the 'Second Rural Connectivity Investment Programme' to improve rural roads in five states of India, ADB said in a statement.

Under this project, ADB will invest to construct and upgrade over 12,000 kilometre rural roads in Assam, Madhya Pradesh, Chhattisgarh, Odisha and West Bengal. It will also support state governments to improve rural road maintenance and safety.

ADB is building on the success of previous assistance for rural roads in India. The agency will work closely with the government to improve connectivity for the rural people to access markets, health centres, education and other opportunities.

In the first tranche, ADB is expected to invest USD 250 million in December for construction of initial 6,254 km all weather rural roads in these states. While the second tranche of the loan of same amount is expected to come by the third quarter of 2019.

This leg of the ADB loan assistance for rural roads builds on the first 'Rural Connectivity Investment Programme in 2012' financing USD 800 million MFF to add about 9,000 km all-weather rural roads in these five states.

Apart from this MFF, the Manila-headquartered agency will provide a USD 500,000 technical assistance (TA) grant from its Technical Assistance Special Fund to strengthen sustainability of rural road assets, disaster resilience and innovation in rural road development.

The TA is due for completion in December 2021, with the investment programme expected to be completed by the end of 2023, ADB said.

Rural roads comprise nearly 80 per cent of India's overall paved road network connecting them to major district roads, state roads and national highways.

|

▼ India records 45 percent jump in number of petrol pumps, third highest in the world! [11-30-17]

India has recorded 45 per cent jump in the number of petrol pumps in the last six years, possibly the highest growth rate in the world, as public and private sector firms jostled to capture retailing sites.

With 60,799 outlets dispensing petrol and diesel at the end of October, India is behind only US and China in number of petrol pumps, data available from Petroleum Planning & Analysis Cell of the Oil Ministry.

In 2011, the country had 41,947 outlets, of which 2,983 or 7.1 per cent, were owned or operated by private retailers like Reliance Industries and Essar oil.

Today, private firms own 5,474, or 9 per cent of the total outlets, with Essar being the leader with 3,980 stations.

Several countries around the globe have seen the number of petrol pumps drop as they moved towards Electric Vehicles (EVs) and alternate forms of energy but they have grown in India, which is the world's fastest growing oil consumer.

India had in 2015 overtaken Japan as the world's third- largest oil consuming country behind US and China. Fuel consumption grew by 9.5 per cent in the April-October period of the current fiscal.

Oil ministry data showed that 18,852 outlets were added between 2011 and 2017. Of the 60,799 petrol pumps in the country, 55,325 are owned by state-owned fuel retailers.

India Oil Corp (IOC) owns and operates 26,489 petrol stations, of which 7,232 are rural outlets. Hindustan Petroleum Corp Ltd (HPCL) is the second biggest fuel retailer with 14,675 outlets, 3,159 being rural sites.

Bharat Petroleum Corp Ltd (BPCL) owns 14,161 outlets, of which 2,548 are rural outlets.

Private Company Growth In Petrol Sector India has recorded 45 per cent jump in the number of petrol pumps in the last six years, possibly the highest growth rate in the world, as public and private sector firms jostled to capture retailing sites.

With 60,799 outlets dispensing petrol and diesel at the end of October, India is behind only US and China in number of petrol pumps, data available from Petroleum Planning & Analysis Cell of the Oil Ministry.

In 2011, the country had 41,947 outlets, of which 2,983 or 7.1 per cent, were owned or operated by private retailers like Reliance Industries and Essar oil.

Today, private firms own 5,474, or 9 per cent of the total outlets, with Essar being the leader with 3,980 stations.

Several countries around the globe have seen the number of petrol pumps drop as they moved towards Electric Vehicles (EVs) and alternate forms of energy but they have grown in India, which is the world's fastest growing oil consumer.

India had in 2015 overtaken Japan as the world's third- largest oil consuming country behind US and China. Fuel consumption grew by 9.5 per cent in the April-October period of the current fiscal.

Oil ministry data showed that 18,852 outlets were added between 2011 and 2017. Of the 60,799 petrol pumps in the country, 55,325 are owned by state-owned fuel retailers.

India Oil Corp (IOC) owns and operates 26,489 petrol stations, of which 7,232 are rural outlets. Hindustan Petroleum Corp Ltd (HPCL) is the second biggest fuel retailer with 14,675 outlets, 3,159 being rural sites.

Bharat Petroleum Corp Ltd (BPCL) owns 14,161 outlets, of which 2,548 are rural outlets.

Private Company Growth In Petrol Sector

- In the private sector, Reliance Industries owns 1,400 outlets while Royal Dutch Shell has 90 stations.

- Besides, there are 1,273 outlets dispensing CNG to automobiles, the most number of 423 being in Delhi, the data showed.

- Industry officials said public sector oil companies will continue to add at least 2,000 petrol pumps per annum over the next few years.

- In the private sector, Essar, which was recently taken over by Russia's Rosneft, had been the most aggressive. It had 1,382 outlets in 2011 and now has 3,980, which it plans to take up to 5,600 by March 2019.

- With deregulation of petrol in June 2010 and diesel in 2014, private players have once again become active on fuel retailing expansion.

|

▼ BN Sharma appointed Chairman of National Anti Profiteering Authority [11-29-17]

The government has set up the National Anti-Profiteering Authority amid reports that some companies, particularly restaurants, are not passing on the benefit of the goods and services tax (GST) rate cuts to consumers.

B N Sharma, additional secretary in the department of revenue, was on 28th Nov 2017 appointed chairman of the authority.

According to the Appointments Committee of the Cabinet (ACC), Sharma is an IAS officer of the Rajasthan cadre of the 1985 batch. He will have the rank and pay of a Secretary in the government.

The authority under the GST regime has been constituted to ensure that the benefit of lower indirect tax rates are passed on to consumers.

The anti-profiteering measures were recently approved by the Union Cabinet and have been designed to ensure that the full benefits of input tax credits and reduced GST rates on supply of goods or services flow to the consumers. The government has set up the National Anti-Profiteering Authority amid reports that some companies, particularly restaurants, are not passing on the benefit of the goods and services tax (GST) rate cuts to consumers.

B N Sharma, additional secretary in the department of revenue, was on 28th Nov 2017 appointed chairman of the authority.

According to the Appointments Committee of the Cabinet (ACC), Sharma is an IAS officer of the Rajasthan cadre of the 1985 batch. He will have the rank and pay of a Secretary in the government.

The authority under the GST regime has been constituted to ensure that the benefit of lower indirect tax rates are passed on to consumers.

The anti-profiteering measures were recently approved by the Union Cabinet and have been designed to ensure that the full benefits of input tax credits and reduced GST rates on supply of goods or services flow to the consumers.

|

▼ New industrial policy to promote emerging sectors [11-28-17]

Commerce and Industry Minister Suresh Prabhu announced the new industrial policy that will seek to promote emerging sectors will be released early next year.

The proposed policy, the draft of which has been prepared by the Commerce and Industry Ministry, will completely revamp the Industrial Policy of 1991.

The draft policy is ready and the ministry is now planning to organise 8-9 roadshows to discuss it with all the stakeholders.

Among other things, the policy would endeavour to reduce regulations and bring in new industries currently in focus.

The Department of Industrial Policy and Promotion (DIPP) in August floated a draft industrial policy with the aim to create jobs for the next two decades, promote foreign technology transfer and attract USD 100 billion FDI annually.

The department is working to formulate an outcome oriented actionable policy that provides direction and charts a course of action for a globally competitive Indian industry that leverages skill, scale and technology. Commerce and Industry Minister Suresh Prabhu announced the new industrial policy that will seek to promote emerging sectors will be released early next year.

The proposed policy, the draft of which has been prepared by the Commerce and Industry Ministry, will completely revamp the Industrial Policy of 1991.

The draft policy is ready and the ministry is now planning to organise 8-9 roadshows to discuss it with all the stakeholders.

Among other things, the policy would endeavour to reduce regulations and bring in new industries currently in focus.

The Department of Industrial Policy and Promotion (DIPP) in August floated a draft industrial policy with the aim to create jobs for the next two decades, promote foreign technology transfer and attract USD 100 billion FDI annually.

The department is working to formulate an outcome oriented actionable policy that provides direction and charts a course of action for a globally competitive Indian industry that leverages skill, scale and technology.

|

▼ Pradhan Mantri Awas Yojana (Urban) Scheme [11-27-17]

The Union Ministry of Housing & Urban Affairs has announced that 30.76 lakh houses for the urban poor have been sanctioned so far since the launch of Pradhan Mantri Awas Yojana (Urban) Scheme in June 2015.

Currently, 15.65 lakh houses are at various stages of construction and about 4.13 lakh houses have been constructed since launch of PMAY (Urban).

PMAY: Know More The Union Ministry of Housing & Urban Affairs has announced that 30.76 lakh houses for the urban poor have been sanctioned so far since the launch of Pradhan Mantri Awas Yojana (Urban) Scheme in June 2015.

Currently, 15.65 lakh houses are at various stages of construction and about 4.13 lakh houses have been constructed since launch of PMAY (Urban).

PMAY: Know More

- At the slum decadal growth rate of 34%, the slum households are projected to go upto 18 million. 2 million non-slum urban poor households are proposed to be covered under the Mission.

- Hence, total housing shortage envisaged to be addressed through the new mission is 20 million.

- The Mission is being implemented during 2015-2022 and provides central assistance to Urban Local Bodies (ULBs) and other implementing agencies through States/UTs for:

- In-situ Rehabilitation of existing slum dwellers using land as a resource through private participation

- Subsidy for beneficiary-led individual house construction/enhancement.

- Credit linked subsidy component is being implemented as a Central Sector Scheme while other three components as Centrally Sponsored Scheme (CSS).

- All statutory towns as per Census 2011 and towns notified subsequently would be eligible for coverage under the Mission.

- In the spirit of cooperative federalism, mission provides flexibility to the States for choosing the best options amongst four verticals of mission to meet the demand of housing in their states.

- Process of project formulation and approval in accordance with the mission Guidelines has been left to the States so that projects can be formulated, approved and implemented faster

- A Technology Sub-Mission under the Mission has been set up to facilitate adoption of modern, innovative and green technologies and building material for faster and quality construction of houses.

- Technology Sub-Mission also facilitates preparation and adoption of layout designs and building plans suitable for various geo-climatic zones.

- It will also assist States/Cities in deploying disaster resistant and environment friendly technologies.

|

▼ 15th Finance Commission approved [11-23-17]

The Union Cabinet chaired by the Prime Minister Narendra Modi has approved setting up of 15th Finance Commission (FC). It is a constitutional obligation to set up FC under Article 280 (1) of the Constitution.

The Terms of Reference for 15th FC will be notified in due course of time. In terms of constitutional provisions, setting up 15th FC, its recommendations will cover five years commencing on April 1, 2020.

15th Finance Commission The Union Cabinet chaired by the Prime Minister Narendra Modi has approved setting up of 15th Finance Commission (FC). It is a constitutional obligation to set up FC under Article 280 (1) of the Constitution.

The Terms of Reference for 15th FC will be notified in due course of time. In terms of constitutional provisions, setting up 15th FC, its recommendations will cover five years commencing on April 1, 2020.

15th Finance Commission

- The recommendations of the 15th Finance Commission will be implemented in the period 1 April 2020 to 31 March 2025.

- The 14th Finance Commission is considered to have fundamentally reset the centre-state fiscal relationship by raising the untied share of states in net central taxes to 42% from 32% after ending discretionary resource transfers from the centre to the states.

- Economist Indira Rajaraman, who was a member of the 13th Finance Commission opined the 15th Finance Commission will change considerably after GST was implemented.

|

▼ ASSOCHAM says Indian food processing sector has billion dollar potential [11-22-17]

India's food processing sector has the potential to attract $33 billion investment by 2024, according to a study released here on 20thNov 2017 by ASSOCHAM.

The country's food and retail market is expected to touch $482 billion by 2020, up from $258 billion in 2015, with recent reforms making the sector more competitive and marke-oriented, it said.

ASSOCHAM: Know More India's food processing sector has the potential to attract $33 billion investment by 2024, according to a study released here on 20thNov 2017 by ASSOCHAM.

The country's food and retail market is expected to touch $482 billion by 2020, up from $258 billion in 2015, with recent reforms making the sector more competitive and marke-oriented, it said.

ASSOCHAM: Know More

- The Associated Chambers of Commerce and Industry of India (ASSOCHAM) is one of the apex trade associations of India.

- The organisation represents the interests of trade and commerce in India, and acts as an interface between industry, government and other relevant stakeholders on policy issues and initiatives.

- The goal of this organisation is to promote both domestic and international trade, and reduce trade barriers while fostering conducive environment for the growth of trade and industry of India.

|

▼ India 51st on IMD Talent Rankings [11-22-17]

India ranked 51st among 63 countries on the IMD Talent Rankings in terms of ability to attract, develop and retain talent. In previous rankings, India was ranked 54th.

The annual IMD World Talent Ranking covers 63 countries and assessed methods countries adopted to attract and retain talent. The rankings of countries are based on their performance in three main categories - investment and development, appeal, and readiness. India ranked 51st among 63 countries on the IMD Talent Rankings in terms of ability to attract, develop and retain talent. In previous rankings, India was ranked 54th.

The annual IMD World Talent Ranking covers 63 countries and assessed methods countries adopted to attract and retain talent. The rankings of countries are based on their performance in three main categories - investment and development, appeal, and readiness.

|

▼ India-WB sign guarantee agreement for IBRD/CTF loan [11-21-17]

The Union Government has signed a guarantee agreement for IBRD/CTF loan of US $98 million and Grant Agreement for US $2 million for Shared Infrastructure for Solar Parks Project with World Bank.

The objective Shared Infrastructure for Solar Parks Project is to increase solar generation capacity through establishment of large-scale parks in the country. The Union Government has signed a guarantee agreement for IBRD/CTF loan of US $98 million and Grant Agreement for US $2 million for Shared Infrastructure for Solar Parks Project with World Bank.

The objective Shared Infrastructure for Solar Parks Project is to increase solar generation capacity through establishment of large-scale parks in the country.

|

▼ Union Cabinet approves NAA [11-20-17]

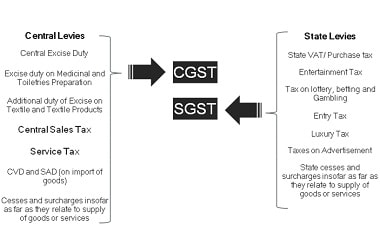

The Union Cabinet approved setting up of National Anti-Profiteering Authority (NAA), an apex body with an overarching mandate under Goods and Services Tax (GST) regime so as to ensure the benefit of tax reaches consumers.

It also approved creation of posts of Chairman and Technical Members of National Anti-profiteering Authority (NAA) under GST regime.

NAA: Know More The Union Cabinet approved setting up of National Anti-Profiteering Authority (NAA), an apex body with an overarching mandate under Goods and Services Tax (GST) regime so as to ensure the benefit of tax reaches consumers.

It also approved creation of posts of Chairman and Technical Members of National Anti-profiteering Authority (NAA) under GST regime.

NAA: Know More

- The establishment of the NAA, to be headed by a senior officer of the level of Secretary to the Government of India with four Technical Members from the Centre and/or the States.

- It is one more measure aimed at reassuring consumers that Government is fully committed to take all possible steps to ensure the benefits of implementation of GST in terms of lower prices of the goods and services reach them.

- It may be recalled that effective from midnight of 14th November, 2017 the GST rate has been slashed from 28% to 18% on goods falling under 178 headings.

- There are now only 50 items which attract the GST rate of 28%.

Likewise, a large number of items have witnessed a reduction in GST rates from 18% to 12% and so on and some goods have been completely exempt from GST.

- The "anti-profiteering" measures enshrined in the GST law provide an institutional mechanism to ensure that the full benefits of input tax credits and reduced GST rates on supply of goods or services flow to the consumers.

- This institutional framework comprises the NAA, a Standing Committee, Screening Committees in every State and the Directorate General of Safeguards in the Central Board of Excise & Customs (CBEC).

|

▼ CCEA allows export of pulses [11-17-17]

The Cabinet Committee on Economic Affairs on 16th Nov, 2017 gave its approval for removing the prohibition on the export of all types of pulses to give the farmers greater choice in marketing their produce for improved incomes.

The CCEA (Cabinet Committee on Economic Affairs) has approved the removal of prohibition on export of all types of pulses.

CCEA: Know More The Cabinet Committee on Economic Affairs on 16th Nov, 2017 gave its approval for removing the prohibition on the export of all types of pulses to give the farmers greater choice in marketing their produce for improved incomes.

The CCEA (Cabinet Committee on Economic Affairs) has approved the removal of prohibition on export of all types of pulses.

CCEA: Know More

- CCEA has a mandate to review economic trends on a continuous basis, as also the problems and prospects, with a view to evolving a consistent and integrated economic policy framework for the country.

- It also directs and coordinates all policies and activities in the economic field including foreign investment that require policy decisions at the highest level.

- Price controls of industrial raw materials and products, industrial licensing policies is undertaken by CCEA

The CCEA also lays down priorities for public sector investment and considers specific proposals for investment of not less than specific levels (Rs. 3 Billion at present) as revised from time to time.

- CCEA facilitates finalization of factual reports on the accomplishments of the Ministries, Agencies and Public Sector Undertakings involved in implementation of prioritized schemes or projects for evaluation by the Prime Minister.

- The CCEA also considers cases of increase in the firmed up cost estimates/revised cost estimates for projects etc. in respect of the business allocated to the CCEA.

- On 2 January 2013, Cabinet Committee on Infrastructure was merged with CCEA.

|

▼ JNPT gets CEZ status [11-17-17]

The Union Government has given go-ahead for setting up India's first mega coastal economic zone (CEZ) at Jawaharlal Nehru Port (JNPT) in Maharashtra.

The first of its kind mega CEZ will stretch along north Konkan region spread across Mumbai, Thane, Pune, Nashik and Raigarh.

About 45 companies across auto, telecom and IT sectors will soon bid for 200 hectares of land to set up manufacturing units in zone.

JNPT: Know More The Union Government has given go-ahead for setting up India's first mega coastal economic zone (CEZ) at Jawaharlal Nehru Port (JNPT) in Maharashtra.

The first of its kind mega CEZ will stretch along north Konkan region spread across Mumbai, Thane, Pune, Nashik and Raigarh.

About 45 companies across auto, telecom and IT sectors will soon bid for 200 hectares of land to set up manufacturing units in zone.

JNPT: Know More

- The Jawaharlal Nehru Port Trust (JNPT) at Navi Mumbai (formerly known as the Nhava Sheva Port) located within the Mumbai harbour on the west coast of India, was commissioned on 26th May 1989.

- It occupies a place of prominence among the major Indian ports.

- It is the second youngest and one of the most modern major ports of the country. Though it was initially planned to be a "satellite port" to the Mumbai Port with the purpose of decongesting traffic at the latter, eventually it was developed as an independent port on its own right and it became the country's largest container port.

- Being one of the oldest ports in India, the Mumbai port was proving to be structurally inadequate to meet the requirements of modern cargo handling.

- There was an urgent need for a new port in the Mumbai region, which eventually led to the birth of JNPT in 1989.

|

▼ Rise in PAN Applications post Demo: CBDT [11-16-17]

CBDT Chairman Sushil Chandra announced while there were around 2.5 lakh PAN applications per month earlier, after the Centre announced to scrap high value currency notes in November last year, the number rose to 7.5 lakh.

Additionally, the department was taking a number of measures to curb black money and that steps such as no cash transaction of above INR 2 lakh was a move in that direction.

CBDT: Know More

The Central Board of Direct Taxes (CBDT) provides essential inputs for policy and planning of direct taxes in India and is also responsible for administration of the direct tax laws through Income Tax Department. The CBDT is a statutory authority functioning under the Central Board of Revenue Act, 1963. It is India's official FATF unit.[21]

Organisational Structure CBDT Chairman Sushil Chandra announced while there were around 2.5 lakh PAN applications per month earlier, after the Centre announced to scrap high value currency notes in November last year, the number rose to 7.5 lakh.

Additionally, the department was taking a number of measures to curb black money and that steps such as no cash transaction of above INR 2 lakh was a move in that direction.

CBDT: Know More

The Central Board of Direct Taxes (CBDT) provides essential inputs for policy and planning of direct taxes in India and is also responsible for administration of the direct tax laws through Income Tax Department. The CBDT is a statutory authority functioning under the Central Board of Revenue Act, 1963. It is India's official FATF unit.[21]

Organisational Structure

- The CBDT is headed by CBDT Chairman and also comprises six members. The Chairperson holds the rank of Special Secretary to Government of India while the members rank of Additional Secretary to Government of India.

Other members:- Member (Income Tax)

- Member (Legislation and Computerisation)

- Member (Revenue)

- Member (Personnel & Vigilance)

- Member (Investigation)

- Member (Audit & Judicial)

- The CBDT Chairman and Members of CBDT are selected from Indian Revenue Service (IRS), a premier civil service of India, whose members constitute the top management of Income Tax Department.

|

▼ 100-year GoI public procurement arm shuts down [11-16-17]

The commerce ministry closed down its nearly 100-year-old public procurement arm–the Directorate General of Supplies and Disposals (DGS&D)-on October 31.

The closure of the DGS&D, which traces its origin to London during the British raj, follows setting up of the government e-market (GeM) platform last year for public procurement of goods and services.

About 1,100 of its employees are being shifted to different departments, including income tax, while the senior officers are likely to be accommodated in other branches of the government. DGS&D assets, which were present across the country, are transferred to the Land and Development Office of the urban development ministry.

The directorate has four regional offices, including Mumbai, Kolkata and Chennai. It has 12 Purchase Directorates. The commerce ministry closed down its nearly 100-year-old public procurement arm–the Directorate General of Supplies and Disposals (DGS&D)-on October 31.

The closure of the DGS&D, which traces its origin to London during the British raj, follows setting up of the government e-market (GeM) platform last year for public procurement of goods and services.

About 1,100 of its employees are being shifted to different departments, including income tax, while the senior officers are likely to be accommodated in other branches of the government. DGS&D assets, which were present across the country, are transferred to the Land and Development Office of the urban development ministry.

The directorate has four regional offices, including Mumbai, Kolkata and Chennai. It has 12 Purchase Directorates.

|

▼ Bharti Airtel sells Infratel stake for INR 3325 crores [11-15-17]

Bharti Airtel on Nov 14, 2017 offloaded 83 million shares of its subsidiary Bharti Infratel for र 3,325 crore through a secondary share sale in the stock market.

Bharti Airtel will primarily use the proceeds to reduce its debt, the company said in a statement. The firm's net debt stood at र 91,480 crore at the end of September 2017.

The sale was for a consideration of more than र 3,325 crore or about $510 million and was executed at a price of र 400.6 a share.

Following the transaction, Bharti Airtel and its wholly-owned subsidiaries hold 53.51% in Bharti Infratel. Promoters held 58% as of September 2017, as per BSE data.

The allocation was done to global investors, fund managers and long only funds, including many repeat investors.

Led by healthy investor appetite, the deal was upsized by over 25%.

J.P. Morgan, UBS and Goldman Sachs were joint placement agents for the transaction. Bharti Airtel on Nov 14, 2017 offloaded 83 million shares of its subsidiary Bharti Infratel for र 3,325 crore through a secondary share sale in the stock market.

Bharti Airtel will primarily use the proceeds to reduce its debt, the company said in a statement. The firm's net debt stood at र 91,480 crore at the end of September 2017.

The sale was for a consideration of more than र 3,325 crore or about $510 million and was executed at a price of र 400.6 a share.

Following the transaction, Bharti Airtel and its wholly-owned subsidiaries hold 53.51% in Bharti Infratel. Promoters held 58% as of September 2017, as per BSE data.

The allocation was done to global investors, fund managers and long only funds, including many repeat investors.

Led by healthy investor appetite, the deal was upsized by over 25%.

J.P. Morgan, UBS and Goldman Sachs were joint placement agents for the transaction.

|

▼ ASSOCHAM report says economy recovering after GST [11-15-17]

Despite a temporary economic slowdown after the implementation of the Goods and Services Tax (GST) in July 2017, India is on the threshold of sustainable growth, according to an ASSOCHAM report.

In its study, titled: "Ideate, Innovate, Implement: the apex industry body held that despite slowdown in growth after GST implementation, India is on the path to growth.

It said that faster GST implementation, removal of check gates between states that have smoothened inter-state movements and central sales tax (CST) no longer being a cost will help improve the situation.

The report maintained that GST will have a significant impact on all aspects of the businesses operating in the country including-supply chain, logistics, cash flows and transactions.

The study said that GST will have an impact on prices agreed for contracts entered under the pre-GST regime and proposed to be executed either partly or completely under the post-GST regime.

Also, the introduction of GST should entail a reduction in overall process on account of reduced tax costs.

The Assocham-EY report also suggested central and state governments need to work in tandem by executing investor-friendly policies to further strengthen investment prospects. Despite a temporary economic slowdown after the implementation of the Goods and Services Tax (GST) in July 2017, India is on the threshold of sustainable growth, according to an ASSOCHAM report.

In its study, titled: "Ideate, Innovate, Implement: the apex industry body held that despite slowdown in growth after GST implementation, India is on the path to growth.

It said that faster GST implementation, removal of check gates between states that have smoothened inter-state movements and central sales tax (CST) no longer being a cost will help improve the situation.

The report maintained that GST will have a significant impact on all aspects of the businesses operating in the country including-supply chain, logistics, cash flows and transactions.

The study said that GST will have an impact on prices agreed for contracts entered under the pre-GST regime and proposed to be executed either partly or completely under the post-GST regime.

Also, the introduction of GST should entail a reduction in overall process on account of reduced tax costs.

The Assocham-EY report also suggested central and state governments need to work in tandem by executing investor-friendly policies to further strengthen investment prospects.

|

▼ National Power Portal launched [11-15-17]

Shri R.K. Singh, Minister of State (IC) for Power and New & Renewable Energy, launched the National Power Portal (NPP) on 14th Nov, 2017. The portal may be accessed at http://npp.gov.in.

NPP is a centralised system for Indian Power Sector which facilitates online data capture/ input (daily, monthly, annually) from generation, transmission and distribution utilities in the country and disseminate Power Sector Information (operational, capacity, demand, supply, consumption etc.).

It works through various analysed reports, graphs, statistics for generation, transmission and distribution at all India, region, state level for central, state and private sector.

The NPP Dashboard has been designed and developed to disseminate analyzed information about the sector through GIS enabled navigation and visualization chart windows on capacity, generation, transmission, distribution at national, state, DISCOM, town, feeder level and scheme based funding to states.

The system also facilitates various types of statutory reports required to be published regularly.

This Dashboard would also act as the single point interface for all Power Sector Apps launched previously by the Ministry, like TARANG, UJALA, VIDYUT PRAVAH, GARV, URJA, MERIT.

NPP is integrated with associated systems of Central Electricity Authority (CEA), Power Finance Corporation (PFC), Rural Electrification Corporation (REC) and other major utilities and would serve as single authentic source of power sector information to apex bodies, utilities for the purpose of analysis, planning, monitoring as well as for public users.

The system is available 24×7 and ensures effective and timely collection of data. It standardized data parameters and formats for seamless exchange of data between NPP and respective systems at utilities.

NPP Stakeholders Shri R.K. Singh, Minister of State (IC) for Power and New & Renewable Energy, launched the National Power Portal (NPP) on 14th Nov, 2017. The portal may be accessed at http://npp.gov.in.

NPP is a centralised system for Indian Power Sector which facilitates online data capture/ input (daily, monthly, annually) from generation, transmission and distribution utilities in the country and disseminate Power Sector Information (operational, capacity, demand, supply, consumption etc.).

It works through various analysed reports, graphs, statistics for generation, transmission and distribution at all India, region, state level for central, state and private sector.

The NPP Dashboard has been designed and developed to disseminate analyzed information about the sector through GIS enabled navigation and visualization chart windows on capacity, generation, transmission, distribution at national, state, DISCOM, town, feeder level and scheme based funding to states.

The system also facilitates various types of statutory reports required to be published regularly.

This Dashboard would also act as the single point interface for all Power Sector Apps launched previously by the Ministry, like TARANG, UJALA, VIDYUT PRAVAH, GARV, URJA, MERIT.

NPP is integrated with associated systems of Central Electricity Authority (CEA), Power Finance Corporation (PFC), Rural Electrification Corporation (REC) and other major utilities and would serve as single authentic source of power sector information to apex bodies, utilities for the purpose of analysis, planning, monitoring as well as for public users.

The system is available 24×7 and ensures effective and timely collection of data. It standardized data parameters and formats for seamless exchange of data between NPP and respective systems at utilities.

NPP Stakeholders

- The stakeholders of NPP are Ministry of Power (MoP), CEA, PFC for Integrated Power Development Scheme (IPDS), REC for Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY), other power sector utilities in government as well as private sector, Apex Bodies, other government organizations and public users.

- The Nodal Agency for implementation of NPP and its operational control is CEA.

- The system has been conceptualized, designed and developed by National Informatics Centre (NIC).

|

▼ GST Council decisions to benefit consumers and businesses [11-13-17]

The Goods and Services Tax Council took a slew of decisions during its 23rd meeting in Guwahati on Friday to benefit consumers and businesses alike.

While consumers will stand to benefit from a number of rate cuts, including the tax on restaurants, businesses stand to benefit from a significant easing of compliance norms to do with filing returns.

Up to November 15, when the decisions take effect, the GST system requires businesses to submit at least three forms to file their returns.

The GSTR-1 dealt with the invoice-wise details of supply, GSTR-2 dealt with the receipts of goods, and GSTR-3 was an overall summary derived from the two previous forms.

Now, the GST Council has decided that, in order to ease the compliance burden on businesses, companies would be allowed to only file the GSTR-1 form, up to March 31, 2018.

The Council has set up a committee to look into how to make the GSTR-2 form easier, following which it will be brought back into the system.

The Council also decided to extend the usage of the summary GSTR-3B form, meant to make life easier for those unfamiliar with the filing process, till March 31 from the earlier December 31 deadline.

Companies with a turnover of up to र1.5 crore a year will now be able to file their GSTR-1 forms for each month in a quarterly manner.

Companies earning र1.5 crore or more a year can file their July to October forms by December 31.

Not only did the latest Council meeting ease the deadlines, but it also slashed the penalties for filing late.

For companies with nil tax liability for a particular month, the penalty for delays has been cut to र20 per day from र200 per day. All other companies will have to file a penalty of र50 per day, down from र200 per day.

The GST Council - the apex body for decision making headed by finance minister Arun Jaitley - also decided to impose a uniform GST rate of 5 percent across all categories of standalone restaurants - air-conditioned and non-air-conditioned - but withdraw the benefits of input tax credit (ITC) from such businesses.

Restaurants in starred hotels and outdoor catering services will attract a GST of 18 percent along with ITC benefits.

Composition Scheme The Goods and Services Tax Council took a slew of decisions during its 23rd meeting in Guwahati on Friday to benefit consumers and businesses alike.

While consumers will stand to benefit from a number of rate cuts, including the tax on restaurants, businesses stand to benefit from a significant easing of compliance norms to do with filing returns.

Up to November 15, when the decisions take effect, the GST system requires businesses to submit at least three forms to file their returns.

The GSTR-1 dealt with the invoice-wise details of supply, GSTR-2 dealt with the receipts of goods, and GSTR-3 was an overall summary derived from the two previous forms.

Now, the GST Council has decided that, in order to ease the compliance burden on businesses, companies would be allowed to only file the GSTR-1 form, up to March 31, 2018.

The Council has set up a committee to look into how to make the GSTR-2 form easier, following which it will be brought back into the system.

The Council also decided to extend the usage of the summary GSTR-3B form, meant to make life easier for those unfamiliar with the filing process, till March 31 from the earlier December 31 deadline.

Companies with a turnover of up to र1.5 crore a year will now be able to file their GSTR-1 forms for each month in a quarterly manner.

Companies earning र1.5 crore or more a year can file their July to October forms by December 31.

Not only did the latest Council meeting ease the deadlines, but it also slashed the penalties for filing late.

For companies with nil tax liability for a particular month, the penalty for delays has been cut to र20 per day from र200 per day. All other companies will have to file a penalty of र50 per day, down from र200 per day.

The GST Council - the apex body for decision making headed by finance minister Arun Jaitley - also decided to impose a uniform GST rate of 5 percent across all categories of standalone restaurants - air-conditioned and non-air-conditioned - but withdraw the benefits of input tax credit (ITC) from such businesses.

Restaurants in starred hotels and outdoor catering services will attract a GST of 18 percent along with ITC benefits.

Composition Scheme

- The annual turnover threshold on the composition scheme will be raised from Rs 1 crore to Rs 1.5 crore.

- This will be done after the law is amended to raise the turnover ceiling for eligibility of composition.

- The law will be amended to raise the ceiling to Rs 2 crore. The limit will be raised immediately after the law amended to Rs 1.5 crore

- Under the scheme, traders, manufacturers and restaurants can pay tax at 1, 2 and 5 percent, respectively.

- The council has also decided to fix a uniform rate of 1 percent for traders and manufacturers.

- The move to widen the turnover threshold is aimed at easing the compliance burden for taxpayers as they will have to file returns only once in a quarter as against monthly returns that needs to be filed by other normal taxpayers.

- However, dealers cannot avail input tax credit, unlike a normal taxpayer.

- Also, traders availing the composition scheme on goods, who also provide small services upto Rs 5 lakh annually, will not be considered ineligible for the scheme.

- GST, billed as the country's biggest indirect tax overhaul, has consolidated a dozen of state and central duties into one single levy.

- ll goods and services have been fitted into four broad slab structure - 5, 12, 18 and 28 percent -along with a cess on luxury and demerit goods such as tobacco, pan masala and aerated drinks.

|

▼ Composition scheme for small businesses: GST Council [11-10-17]

The twenty-third meeting of the Goods and Services Tax (GST) Council in Guwahati on Friday is set to tighten the noose on players who, authorities believe, have started splitting their business operations into smaller entities to avoid higher tax liabilities.

The Council is also set to cut tax rates on a large number of product lines.

The Council is expected to further liberalise the Composition Scheme for small businesses and traders to pay a flat and low tax on their turnover.

The annual turnover eligibility threshold is likely to be raised to ₹1.5 crore from the ₹1 crore limit, imposed at the Council's October meeting.

However, the government is concerned about the emergence of a parallel economy despite the restrictions on the Composition Scheme, whose original threshold limit was just ₹75 lakh a year.

Small States may have legitimate concerns, but the restriction on inter-State supplies by businesses under the Composition Scheme could also fuel the prospects for more informal trade outside the tax net.

The GoM has not been able to arrive at a consensus on the question of whether supplies from small firms that are part of the Composition Scheme should translate into input tax credits for larger firms who buy from them. The twenty-third meeting of the Goods and Services Tax (GST) Council in Guwahati on Friday is set to tighten the noose on players who, authorities believe, have started splitting their business operations into smaller entities to avoid higher tax liabilities.

The Council is also set to cut tax rates on a large number of product lines.

The Council is expected to further liberalise the Composition Scheme for small businesses and traders to pay a flat and low tax on their turnover.

The annual turnover eligibility threshold is likely to be raised to ₹1.5 crore from the ₹1 crore limit, imposed at the Council's October meeting.

However, the government is concerned about the emergence of a parallel economy despite the restrictions on the Composition Scheme, whose original threshold limit was just ₹75 lakh a year.

Small States may have legitimate concerns, but the restriction on inter-State supplies by businesses under the Composition Scheme could also fuel the prospects for more informal trade outside the tax net.

The GoM has not been able to arrive at a consensus on the question of whether supplies from small firms that are part of the Composition Scheme should translate into input tax credits for larger firms who buy from them.

|

▼ Import duty on wheat at a high of 20 percent! [11-10-17]

The government on Nov 8, 2017 doubled the import duty on wheat to 20 per cent to curb cheap shipments and give positive price signal to farmers in the ongoing Rabi season.

It also imposed import duty of 50 percent on peas to check cheaper shipments from countries like Canada.

The Central Board of Excise and Customs (CBEC) in a notification said that it seeks to (i) increase rate of basic customs duty on Peas, (Pisum sativum) from present Nil rate to 50%. (ii) increase rate of basic customs duty on wheat from 10% to 20%.

In March, the government had imposed 10 percent import duty on wheat to contain sharp fall in local prices in view of bumper crop of 98.38 million tonnes in 2016-17 crop year (July-June).

As farmers have started planting of rabi (winter) wheat crop, the government wants to give positive price signal and encourage farmers to grow wheat in more area.

The government does not want wheat growers to follow the way of pulses farmers who shifted to other crops this kharif season as prices remained low just before the sowing period owing to bumper crop last year.

India produced a record 22 million tonnes of pulses in 2016-17 crop year which led to a fall in domestic prices, even below the MSP.

Moreover, the country also imported about 5 million tonnes of pulses last fiscal.

The import duty on peas has been imposed to curb shipments and boost domestic prices.

Recently, the government had also imposed quantitative restrictions on import of other pulses like tur. The government on Nov 8, 2017 doubled the import duty on wheat to 20 per cent to curb cheap shipments and give positive price signal to farmers in the ongoing Rabi season.

It also imposed import duty of 50 percent on peas to check cheaper shipments from countries like Canada.

The Central Board of Excise and Customs (CBEC) in a notification said that it seeks to (i) increase rate of basic customs duty on Peas, (Pisum sativum) from present Nil rate to 50%. (ii) increase rate of basic customs duty on wheat from 10% to 20%.

In March, the government had imposed 10 percent import duty on wheat to contain sharp fall in local prices in view of bumper crop of 98.38 million tonnes in 2016-17 crop year (July-June).

As farmers have started planting of rabi (winter) wheat crop, the government wants to give positive price signal and encourage farmers to grow wheat in more area.

The government does not want wheat growers to follow the way of pulses farmers who shifted to other crops this kharif season as prices remained low just before the sowing period owing to bumper crop last year.

India produced a record 22 million tonnes of pulses in 2016-17 crop year which led to a fall in domestic prices, even below the MSP.

Moreover, the country also imported about 5 million tonnes of pulses last fiscal.

The import duty on peas has been imposed to curb shipments and boost domestic prices.

Recently, the government had also imposed quantitative restrictions on import of other pulses like tur.

|

▼ Two MoUs signed in the area of skill development and entrepreneurship [11-9-17]

Two Memorandum of Understanding (MoUs) have been signed between Indian Institute of Corporate Affairs, Atal Innovation Mission - Niti Ayog and Haryana Vishwakarma Skill University in Delhi on Nov 8, 2017.

The partnerships on skill development and entrepreneurship seek to align with the National Priority Areas.

Therefore, quality deliverables under these collaborations will go a long way in initiating and sustaining innovative approaches towards strengthening the enterprise movement in the country.

With an aim of enabling millions and millions of Indian youth acquire necessary skills and contribute towards making India a modern country, India has launched 'Skilling India' as a multi-skill development programme on mission mode for job creation and entrepreneurship skill development for all socio-economic classes.

To realise this dream, upgrading skills to international standards through significant industry involvement and developing necessary frameworks for standards, curriculum and quality assurance are the prerequisites.

Along with impetus on Skilling India, promotion of Entrepreneurship is being pursued by Government through 'Start-up India'.

Incubators plays a vital role as the incubation process not only provided the start-up with an inspiring environment, quality mentoring and a support structure, it also helped them refine their business model and get access to an economical, yet professional working space.

IICA has explored ways to collaborate and undertake various activities to promote incubation/ entrepreneurship and innovation.

To facilitate activities such as capacity building programmes/ workshops/ seminar, research in area of incubation, innovation, skill development etc., IICA has inked the Statement of Intent with Atal Innovation Mission-Niti Aayog and the Memorandum of Understanding with Haryana Vishwakarma Skill University.

These collaborations are likely to provide the opportunities for all stakeholders to participate and contribute to larger cause of incubation and skill creation. Two Memorandum of Understanding (MoUs) have been signed between Indian Institute of Corporate Affairs, Atal Innovation Mission - Niti Ayog and Haryana Vishwakarma Skill University in Delhi on Nov 8, 2017.

The partnerships on skill development and entrepreneurship seek to align with the National Priority Areas.

Therefore, quality deliverables under these collaborations will go a long way in initiating and sustaining innovative approaches towards strengthening the enterprise movement in the country.

With an aim of enabling millions and millions of Indian youth acquire necessary skills and contribute towards making India a modern country, India has launched 'Skilling India' as a multi-skill development programme on mission mode for job creation and entrepreneurship skill development for all socio-economic classes.

To realise this dream, upgrading skills to international standards through significant industry involvement and developing necessary frameworks for standards, curriculum and quality assurance are the prerequisites.

Along with impetus on Skilling India, promotion of Entrepreneurship is being pursued by Government through 'Start-up India'.

Incubators plays a vital role as the incubation process not only provided the start-up with an inspiring environment, quality mentoring and a support structure, it also helped them refine their business model and get access to an economical, yet professional working space.

IICA has explored ways to collaborate and undertake various activities to promote incubation/ entrepreneurship and innovation.

To facilitate activities such as capacity building programmes/ workshops/ seminar, research in area of incubation, innovation, skill development etc., IICA has inked the Statement of Intent with Atal Innovation Mission-Niti Aayog and the Memorandum of Understanding with Haryana Vishwakarma Skill University.

These collaborations are likely to provide the opportunities for all stakeholders to participate and contribute to larger cause of incubation and skill creation.

|

▼ US India's topmost exporting destination: EEPC India [11-7-17]

Indian engineering exports are benefiting from an impressive turnaround in demand in most of the developed economies especially the U.S., which accounted for an annual growth of 91% in shipments in September this fiscal, according to an analysis by EEPC India, the apex body for Indian engineering exporters.

The U.S. continued to be the topmost exporting destination for India's engineering products in September 2017, registering a huge expansion both on monthly as well as on cumulative basis during April-September 2017-18 over the same period last fiscal.

While the shipments of engineering exports to the US went up by a whopping 91% to $1.53 billion in September, 2017 from $551 million in the same month last fiscal, the April-September exports had gone up over by 47% to $4.79 billion from $3.25 billion in the first half of the previous fiscal.

Since the demand pick up, particularly in iron and steel, all ferrous and non-ferrous metals, is evident in the global market, the exports are expected to remain buoyant.

All European nations falling under the top 25 engineering export destinations like Germany, Italy, Belgium, Netherland, France and Poland also recorded considerable growth.

Engineering exports to Germany saw a jump of over 67% to $288 million in September, 2017 over $172 million in the same month last fiscal.

Likewise, the shipments to Italy rose by 30% to $209 million from $161 million. Indian engineering exports are benefiting from an impressive turnaround in demand in most of the developed economies especially the U.S., which accounted for an annual growth of 91% in shipments in September this fiscal, according to an analysis by EEPC India, the apex body for Indian engineering exporters.

The U.S. continued to be the topmost exporting destination for India's engineering products in September 2017, registering a huge expansion both on monthly as well as on cumulative basis during April-September 2017-18 over the same period last fiscal.

While the shipments of engineering exports to the US went up by a whopping 91% to $1.53 billion in September, 2017 from $551 million in the same month last fiscal, the April-September exports had gone up over by 47% to $4.79 billion from $3.25 billion in the first half of the previous fiscal.

Since the demand pick up, particularly in iron and steel, all ferrous and non-ferrous metals, is evident in the global market, the exports are expected to remain buoyant.

All European nations falling under the top 25 engineering export destinations like Germany, Italy, Belgium, Netherland, France and Poland also recorded considerable growth.

Engineering exports to Germany saw a jump of over 67% to $288 million in September, 2017 over $172 million in the same month last fiscal.

Likewise, the shipments to Italy rose by 30% to $209 million from $161 million.

|

▼ Gujarat misses top spot, Karnataka India's leading investment destination [11-6-17]

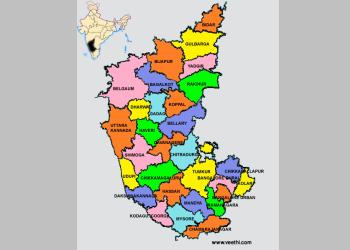

Poll-bound Gujarat, with 'investment intentions' worth INR 65,741 crore obtained during the period January-September this year, is behind the national topper Karnataka that bagged 'investment intentions' worth INR 147,625 crore in the period.

Karnataka, with investment intentions of INR 154,173 crore had last year (January-December) wrested the numero uno spot from Gujarat that got investment proposals of INR 56,156 crore.

In 2015, Gujarat was the state with the maximum 'investment intentions' in value terms with INR 64,733 crore, while Karnataka was only the fourth with INR 31,668 crore.

Other States leading in 'investment intentions' during January-September 2017 were Maharashtra (INR 25,018 crore), Andhra Pradesh (INR 24,031 crore), Jharkhand (INR 13,002 crore), Telangana (INR 12,567 crore) and Uttar Pradesh (INR 9,443).

India received investment proposals of INR 332,266 crore till September this year. In all of 2016, the country had received intentions worth INR 414,086 crore, while it received only INR 311,031 crore in 2015.

A state-wise assessment of implementation of the 340 reform recommendations in 2016 had seen Gujarat ranked third behind Andhra Pradesh and Telengana, while Karnataka was 13th in the list. The business reforms action plan in 2017 includes 405 reform recommendations, and the latest implementation scorecard shows Telengana topping the list, followed by Haryana and West Bengal, while Karnataka is eighth and Gujarat ninth. Poll-bound Gujarat, with 'investment intentions' worth INR 65,741 crore obtained during the period January-September this year, is behind the national topper Karnataka that bagged 'investment intentions' worth INR 147,625 crore in the period.

Karnataka, with investment intentions of INR 154,173 crore had last year (January-December) wrested the numero uno spot from Gujarat that got investment proposals of INR 56,156 crore.

In 2015, Gujarat was the state with the maximum 'investment intentions' in value terms with INR 64,733 crore, while Karnataka was only the fourth with INR 31,668 crore.

Other States leading in 'investment intentions' during January-September 2017 were Maharashtra (INR 25,018 crore), Andhra Pradesh (INR 24,031 crore), Jharkhand (INR 13,002 crore), Telangana (INR 12,567 crore) and Uttar Pradesh (INR 9,443).

India received investment proposals of INR 332,266 crore till September this year. In all of 2016, the country had received intentions worth INR 414,086 crore, while it received only INR 311,031 crore in 2015.

A state-wise assessment of implementation of the 340 reform recommendations in 2016 had seen Gujarat ranked third behind Andhra Pradesh and Telengana, while Karnataka was 13th in the list. The business reforms action plan in 2017 includes 405 reform recommendations, and the latest implementation scorecard shows Telengana topping the list, followed by Haryana and West Bengal, while Karnataka is eighth and Gujarat ninth.

|

▼ India set to become third-largest aviation market in the world [11-3-17]

India is witnessing a high-growth trajectory and set to become the third-largest aviation market in the world in terms of passengers by 2026.

The announcement was made at the 2nd India aero expo 2017 inaugurated by Vice President Shri Venkaaih Naidu.

The aviation sector not only plays a key role in promoting connectivity and creating jobs but is also an important driver of the economy.

Aviation is the backbone of the global transport system. It indeed is the most vital sector for linking businesses, bringing people together and promoting tourism worldwide.

India became the world’s fastest growing domestic travel market for the 22nd time in a row recording a 26.6 per cent year-on-year growth in January 2017, according to IATA.

India's Aviation Sector: Know More India is witnessing a high-growth trajectory and set to become the third-largest aviation market in the world in terms of passengers by 2026.

The announcement was made at the 2nd India aero expo 2017 inaugurated by Vice President Shri Venkaaih Naidu.

The aviation sector not only plays a key role in promoting connectivity and creating jobs but is also an important driver of the economy.

Aviation is the backbone of the global transport system. It indeed is the most vital sector for linking businesses, bringing people together and promoting tourism worldwide.

India became the world’s fastest growing domestic travel market for the 22nd time in a row recording a 26.6 per cent year-on-year growth in January 2017, according to IATA.

India's Aviation Sector: Know More

- India is witnessing a high-growth trajectory and set to become the third-largest aviation market in the world in terms of passengers by 2026.

- India’s air cargo is estimated to grow at 9 per cent over the next few years.

- IATA also expects the air passengers to double from 3.8 billion air passengers in 2016 to 7.2 billion by 2035.

- India replaced Japan to become the largest domestic aviation market globally.

- India recorded a total of 100 million domestic flyers in 2016 as compared to 97 million people who travelled by air in Japan during the same period.

Government Measures to Promote Aviation- Recognizing the growing importance of the aviation sector, the Government has taken a series of measures to improve infrastructure and regional air connectivity in the country.

- UDAN scheme seeks to promote regional connectivity by serving the un-served and under-served airports. Connecting Tier-II cities, pilgrim towns and historic places with the wider air routes is important for boosting tourism and business travel.

- Among others, developing no frills and Greenfield airports, augmenting existing capacities, creating synergy between scheduled and non-scheduled airlines for better penetration and connectivity through collaborative efforts of the State and Central Governments is needed.

|

▼ Government panel to oversee PSB mergers [11-1-17]

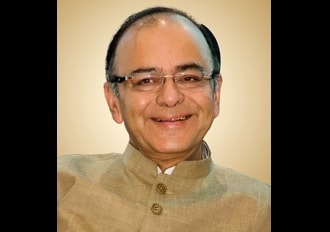

Moving ahead with reforms in the public sector banking space, the government has constituted a ministerial panel headed by Finance Minister Arun Jaitley that will oversee merger proposals of state-owned banks.

The other members of the panel include Railway and Coal Minister Piyush Goyal and Defence Minister Nirmala Sitharaman.

While announcing the unprecedented INR 2.11 lakh crore capital infusion roadmap for the public sector banks (PSBs) last week, Jaitley indicated this will be accompanied by series of banking reforms over the next few months.

The constitution of Alternative Mechanism (AM) is a movement in that direction.

The Cabinet in August had decided to set up an Alternative Mechanism to fast-track consolidation among public sector banks to create strong lenders.

The move to create large banks aims at meeting the credit needs of the growing Indian economy and building capacity in the PSB space to raise resources without dependence on the state exchequer.

The mechanism will oversee the proposals coming from boards of PSBs for consolidation.

The decision to set up such a mechanism follows State Bank of India merging its five associate banks, as also the Bharatiya Mahila Bank, with itself. Moving ahead with reforms in the public sector banking space, the government has constituted a ministerial panel headed by Finance Minister Arun Jaitley that will oversee merger proposals of state-owned banks.

The other members of the panel include Railway and Coal Minister Piyush Goyal and Defence Minister Nirmala Sitharaman.

While announcing the unprecedented INR 2.11 lakh crore capital infusion roadmap for the public sector banks (PSBs) last week, Jaitley indicated this will be accompanied by series of banking reforms over the next few months.

The constitution of Alternative Mechanism (AM) is a movement in that direction.

The Cabinet in August had decided to set up an Alternative Mechanism to fast-track consolidation among public sector banks to create strong lenders.

The move to create large banks aims at meeting the credit needs of the growing Indian economy and building capacity in the PSB space to raise resources without dependence on the state exchequer.

The mechanism will oversee the proposals coming from boards of PSBs for consolidation.

The decision to set up such a mechanism follows State Bank of India merging its five associate banks, as also the Bharatiya Mahila Bank, with itself.

|