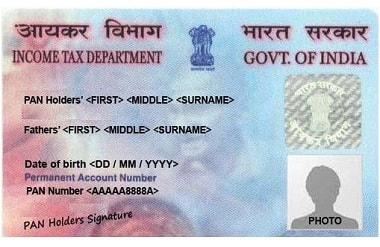

Rise in PAN Applications post Demo: CBDT

Q. CBDT reported a rise in PAN applications post demonetisation. What was the number?- Published on 16 Nov 17a. 300%

b. 200%

c. 500%

d. 100%

ANSWER: 300%

CBDT Chairman Sushil Chandra announced while there were around 2.5 lakh PAN applications per month earlier, after the Centre announced to scrap high value currency notes in November last year, the number rose to 7.5 lakh.

Additionally, the department was taking a number of measures to curb black money and that steps such as no cash transaction of above INR 2 lakh was a move in that direction.

CBDT: Know More The Central Board of Direct Taxes (CBDT) provides essential inputs for policy and planning of direct taxes in India and is also responsible for administration of the direct tax laws through Income Tax Department. The CBDT is a statutory authority functioning under the Central Board of Revenue Act, 1963. It is India's official FATF unit.[21]

Organisational Structure- The CBDT is headed by CBDT Chairman and also comprises six members. The Chairperson holds the rank of Special Secretary to Government of India while the members rank of Additional Secretary to Government of India.

Other members:- Member (Income Tax)

- Member (Legislation and Computerisation)

- Member (Revenue)

- Member (Personnel & Vigilance)

- Member (Investigation)

- Member (Audit & Judicial)

- The CBDT Chairman and Members of CBDT are selected from Indian Revenue Service (IRS), a premier civil service of India, whose members constitute the top management of Income Tax Department.