▼ What is Yale model in finance? [11-29-17]

Also known as the endowment model or the Harvard model, this refers to the investment strategy followed by many popular endowment funds created by institutions like universities, hospitals and other non-profit organisations.

It emphasises the importance of diversifying an investment portfolio equally across multiple asset classes to control risk, but with a special focus on investing in alternative assets that can offer higher returns to its investors.

The Yale model was proposed and popularised by David F. Swensen, the chief investment officer of Yale University, who elaborated on it in his 2000 book Pioneering Portfolio Management. Also known as the endowment model or the Harvard model, this refers to the investment strategy followed by many popular endowment funds created by institutions like universities, hospitals and other non-profit organisations.

It emphasises the importance of diversifying an investment portfolio equally across multiple asset classes to control risk, but with a special focus on investing in alternative assets that can offer higher returns to its investors.

The Yale model was proposed and popularised by David F. Swensen, the chief investment officer of Yale University, who elaborated on it in his 2000 book Pioneering Portfolio Management.

|

▼ Air Deccan to start operations under Udan Scheme [11-27-17]

Low cost airline Air Deccan is all set to start operations under the regional connectivity scheme (RCS), also known as UDAN (Ude Desh Ka Aam Nagrik), from December 15 this year, airport officials here said on Sunday.

Under the Centre's UDAN scheme, air fares are capped at Rs 2,500 per person for an hour's flight to Tier-2 and Tier-3 cities in which the government will provide subsidy for flying with such low fares. Low cost airline Air Deccan is all set to start operations under the regional connectivity scheme (RCS), also known as UDAN (Ude Desh Ka Aam Nagrik), from December 15 this year, airport officials here said on Sunday.

Under the Centre's UDAN scheme, air fares are capped at Rs 2,500 per person for an hour's flight to Tier-2 and Tier-3 cities in which the government will provide subsidy for flying with such low fares.

|

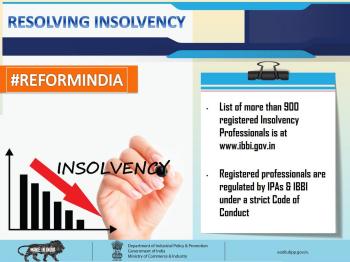

▼ Ordinance for Insolvency and Bankruptcy Code [11-24-17]

The President of India has given his assent to the Ordinance to amend the Insolvency and Bankruptcy Code, 2016 (the Code).

The Ordinance aims at putting in place safeguards to prevent unscrupulous, undesirable persons from misusing or vitiating the provisions of the Code.

The amendments aim to keep out such persons who have wilfully defaulted, are associated with non-performing assets, or are habitually non-compliant and, therefore, are likely to be a risk to successful resolution of insolvency of a company.

In addition to putting in place restrictions for such persons to participate in the resolution or liquidation process, the amendment also provides such check by specifying that the Committee of Creditors ensure the viability and feasibility of the resolution plan before approving it.

The Insolvency and Bankruptcy Board of India (IBBI) has also been given additional powers The President of India has given his assent to the Ordinance to amend the Insolvency and Bankruptcy Code, 2016 (the Code).

The Ordinance aims at putting in place safeguards to prevent unscrupulous, undesirable persons from misusing or vitiating the provisions of the Code.

The amendments aim to keep out such persons who have wilfully defaulted, are associated with non-performing assets, or are habitually non-compliant and, therefore, are likely to be a risk to successful resolution of insolvency of a company.

In addition to putting in place restrictions for such persons to participate in the resolution or liquidation process, the amendment also provides such check by specifying that the Committee of Creditors ensure the viability and feasibility of the resolution plan before approving it.

The Insolvency and Bankruptcy Board of India (IBBI) has also been given additional powers

|

▼ India to export cotton as pink bollworm strikes [11-24-17]

India is likely to export nearly one-fifth less cotton than previously estimated as pink bollworms are set to eat into the south Asian country's output which was expected to hit a record, industry officials told Reuters.

Lower exports from the world's biggest producer will help its rivals like the US, Brazil and Australia to raise their exports to Asian buyers like Pakistan, China and Bangladesh.

Pink Bollworms India is likely to export nearly one-fifth less cotton than previously estimated as pink bollworms are set to eat into the south Asian country's output which was expected to hit a record, industry officials told Reuters.

Lower exports from the world's biggest producer will help its rivals like the US, Brazil and Australia to raise their exports to Asian buyers like Pakistan, China and Bangladesh.

Pink Bollworms

- The pink bollworm (Pectinophora gossypiella), is an insect known for being a pest in cotton farming.

- The adult is a small, thin, gray moth with fringed wings. The larva is a dull white, eight-legged caterpillar with conspicuous pink banding along its dorsum.

- The larva reaches one half inch in length.

- The pink bollworm is native to Asia, but has become an invasive species in most of the world's cotton-growing regions.

- It reached the cotton belt in the southern United States by the 1920s.

- It is a major pest in the cotton fields of the southern California deserts.

- In parts of India, the pink bollworm is now resistant to first generation transgenic Bt cotton (Bollgard cotton) that expresses a single Bt gene (Cry1Ac).

- Monsanto has admitted that this variety is ineffective against the pink bollworm pest in parts of Gujarat, India.

|

▼ EBRD approves India's membership [11-23-17]

The Union Cabinet has approved India's Membership for European Bank for Reconstruction & Development (EBRD). Department of Economic Affairs,

Ministry of Finance will take necessary steps to acquire the membership of the EBRD.

The membership of EBRD will enhance India's international profile and promote its economic interests.

It will give India access to EBRD's Countries of Operation and sector knowledge. Moreover, it will boost India's investment opportunities and also improve investment climate in country. The Union Cabinet has approved India's Membership for European Bank for Reconstruction & Development (EBRD). Department of Economic Affairs,

Ministry of Finance will take necessary steps to acquire the membership of the EBRD.

The membership of EBRD will enhance India's international profile and promote its economic interests.

It will give India access to EBRD's Countries of Operation and sector knowledge. Moreover, it will boost India's investment opportunities and also improve investment climate in country.

|

▼ Buyback slated for Infosys [11-20-17]

Infosys on Nov 17th said share buyback would begin on November 30 and close on December 14.

The IT services major has issued an offer letter for the buyback of shares.

It said that the necessary forms along with the letter would be dispatched to the eligible shareholders whose names appeared on the record date of November 1.

Infosys: Know More Infosys on Nov 17th said share buyback would begin on November 30 and close on December 14.

The IT services major has issued an offer letter for the buyback of shares.

It said that the necessary forms along with the letter would be dispatched to the eligible shareholders whose names appeared on the record date of November 1.

Infosys: Know More

- Industry: IT services, IT consulting

- Founded: 7 July 1981; 36 years ago

- Founders:

- N. R. Narayana Murthy

- Nandan Nilekani

- S. Gopalakrishnan

- S. D. Shibulal

- K. Dinesh

- N. S. Raghavan

- Ashok Arora

- Headquarters: Bengaluru, Karnataka, India

- Services: IT, business consulting and outsourcing services

|

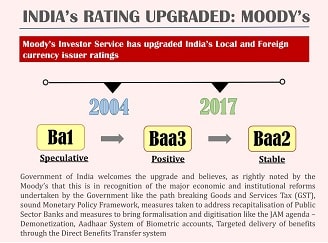

▼ Moody's increases India's rating [11-20-17]

Moody's Investors Service raised India's sovereign rating for the first time since 2004, overlooking a haze of short-term economic uncertainties to bet on the nation's prospects from a raft of policy changes by Prime Minister Narendra Modi.

Rupee, bonds and stocks rallied after the ratings firm upgraded India to Baa2 from Baa3 and said reforms being pushed through by Modi's government will help stabilize rising levels of debt.

That's a one-level shift from the lowest investment-grade ranking and puts India in line with the Philippines and Italy.

While government officials hailed the move as long overdue, some investors termed it a surprise given that India recently surrendered its status as the world's fastest-growing major economy amid sweeping policy change.

The upgrade could prove to be a big win for the ruling party, which is facing increasing attacks about the economic slowdown before key elections in Modi's home state next month and a national vote early 2019.

Credit Rating: Know More Moody's Investors Service raised India's sovereign rating for the first time since 2004, overlooking a haze of short-term economic uncertainties to bet on the nation's prospects from a raft of policy changes by Prime Minister Narendra Modi.

Rupee, bonds and stocks rallied after the ratings firm upgraded India to Baa2 from Baa3 and said reforms being pushed through by Modi's government will help stabilize rising levels of debt.

That's a one-level shift from the lowest investment-grade ranking and puts India in line with the Philippines and Italy.

While government officials hailed the move as long overdue, some investors termed it a surprise given that India recently surrendered its status as the world's fastest-growing major economy amid sweeping policy change.

The upgrade could prove to be a big win for the ruling party, which is facing increasing attacks about the economic slowdown before key elections in Modi's home state next month and a national vote early 2019.

Credit Rating: Know More

- A credit rating is an assessment of the creditworthiness of a borrower. Individuals, corporations and governments are assigned credit ratings - whoever wants to borrow money. Individuals are given 'credit scores', while corporations and governments receive 'credit ratings'.

- National governments, not countries, are assigned credit ratings by agencies like Standard & Poor's, Moody's and Fitch.

- Governments require ratings to borrow money. They are also given ratings on their worth as investment destinations.

- A country requests a credit rating agency to evaluate its economic and political environment and arrive at a rating. This is done to position itself as a destination for foreign direct investment.

- There are several criteria behind rating a government's creditworthiness. Among them are political risk, taxation, currency value and labour laws.

- Another is sovereign risk where a country's central bank can change its foreign exchange regulations.

- For the first time in 14 years, Moody's has upgraded India's rating to Baa2, a term that means that they consider the economy stable.

- Standard & Poor's and Fitch too have a 'stable' rating for the country - BBB+ and BBB-, respectively.

|

▼ IDC says PC shipments on the rise [11-17-17]

PC shipments in India witnessed 20.5 per cent growth in September 2017 quarter over the year- ago period to 3.03 million units, helped by strong consumer demand and special projects, research firm IDC indicated, between July and September, registering a strong quarter-on-quarter (q-o-q) growth of 72.3% and year-on-year (y-o-y) growth of 20.5%.

This comes as a big surprise, after the struggles of the PC makers in the June quarter, when shipments fell by 18.9% (q-o-q) and by 18% (y-o-y), with only 1.75 million units shipped in that quarter.

IDC analysts believe the PC OEMs are likely to hit the wall again in Q4 2017.

The India PC market in the December quarter is expected to decline due to seasonality and reduced consumer demand after the high consumer spending in the September quarter.

However, going forward, the excitement around gaming PCs and price drops after GST (goods and services tax) will remain important factors for the consumer segment. PC shipments in India witnessed 20.5 per cent growth in September 2017 quarter over the year- ago period to 3.03 million units, helped by strong consumer demand and special projects, research firm IDC indicated, between July and September, registering a strong quarter-on-quarter (q-o-q) growth of 72.3% and year-on-year (y-o-y) growth of 20.5%.

This comes as a big surprise, after the struggles of the PC makers in the June quarter, when shipments fell by 18.9% (q-o-q) and by 18% (y-o-y), with only 1.75 million units shipped in that quarter.

IDC analysts believe the PC OEMs are likely to hit the wall again in Q4 2017.

The India PC market in the December quarter is expected to decline due to seasonality and reduced consumer demand after the high consumer spending in the September quarter.

However, going forward, the excitement around gaming PCs and price drops after GST (goods and services tax) will remain important factors for the consumer segment.

|

▼ Kwitz: Glenmark Pharma launches NRT [11-17-17]

Glenmark Pharmaceuticals on 16th Nov, 2017 said it has launched nicotine replacement therapy product Kwitz that helps smokers quit smoking.prescription product, the company said in a statement.

Kwitz nicotine gum will be available in two variants of 2 mg as an OTC product 4mg as prescription product, the company said in a statement.

Kwitz nicotine gum will be available in two variants of 2 mg as an OTC product 4mg as prescription product, the company said in a statement.

While Kwitz 2 mg is for those smoking less than 20 cigarettes per day, Kwitz 4 mg is meant for smokers consuming more than 20 cigarettes per day, it added.

Kwitz is aimed at helping individuals find a sustainable way to stop smoking in an easy step-by-step process. Glenmark Pharmaceuticals on 16th Nov, 2017 said it has launched nicotine replacement therapy product Kwitz that helps smokers quit smoking.prescription product, the company said in a statement.

Kwitz nicotine gum will be available in two variants of 2 mg as an OTC product 4mg as prescription product, the company said in a statement.

Kwitz nicotine gum will be available in two variants of 2 mg as an OTC product 4mg as prescription product, the company said in a statement.

While Kwitz 2 mg is for those smoking less than 20 cigarettes per day, Kwitz 4 mg is meant for smokers consuming more than 20 cigarettes per day, it added.

Kwitz is aimed at helping individuals find a sustainable way to stop smoking in an easy step-by-step process.

|

▼ Flipkart ready with its smartphone! [11-16-17]

A lot of market intelligence that was acquired over a period of time by India's leading e-commerce company Flipkart is being put to test as the company's own smart phone product is going on sale under Billion Capture + brand in INR 10,000 price bracket from November 15, 2017.

Hyderabad-based homegrown technology OEM Smartron has worked on Flipkart's maiden smart phone product in terms of design and development besides getting it manufactured for the e-commerce company.

The partnership with Flipkart comes as a big breakthrough for Smartron as it has been looking for opportunities. A lot of market intelligence that was acquired over a period of time by India's leading e-commerce company Flipkart is being put to test as the company's own smart phone product is going on sale under Billion Capture + brand in INR 10,000 price bracket from November 15, 2017.

Hyderabad-based homegrown technology OEM Smartron has worked on Flipkart's maiden smart phone product in terms of design and development besides getting it manufactured for the e-commerce company.

The partnership with Flipkart comes as a big breakthrough for Smartron as it has been looking for opportunities.

|

▼ BHARAT 22 ETF launched [11-15-17]

The Government of India launched the BHARAT-22 Exchange Traded Fund (ETF) managed by ICICI Prudential Mutual Fund targeting an initial amount of about INR 8,000 crore on 14th Nov, 2017.

This New Fund Offer is open till November 17, 2017.

The Units of the Scheme will be allotted 25% to each category of investors. In this ETF, the Retirement Fund has been made separate category of Investors.

In case of spill-over, additional portion will be allocated giving preference to retail and retirement funds. There is a 3% discount across the board.

The strength of this ETF lies in the specially created Index S&P BSE BHARAT-22 INDEX.

This Index is a unique blend of shares of key CPSEs, Public Sector Banks (PSBs) and also the Government owned shares in blue chip private companies like Larsen & Tubro (L&T), Axis Bank and ITC.

The shares of the Government companies represent 6 core sectors of the economy-Finance, Industry, Energy, Utilities, Fast Moving Consumer Goods (FMCG) and Basic Materials.

The index has previously out-performed the NIFTY-50 and Sensex.

The Index constituents include leading Maharatanas and Navratanas such as Coal India, GAIL, Power Grid Corporation of India Ltd. (PGCIL), National Thermal Power Corporation (NTPC), Indian Oil Corporation Ltd., Oil & Natural Gas Corporation (ONGC), Bharat Petroleum, and National Aluminium Company (NALCO), three Public Sector Banks such as SBI, Bank of Baroda apart from the 3 private sector companies mentioned earlier.

Reforms and ETF The Government of India launched the BHARAT-22 Exchange Traded Fund (ETF) managed by ICICI Prudential Mutual Fund targeting an initial amount of about INR 8,000 crore on 14th Nov, 2017.

This New Fund Offer is open till November 17, 2017.

The Units of the Scheme will be allotted 25% to each category of investors. In this ETF, the Retirement Fund has been made separate category of Investors.

In case of spill-over, additional portion will be allocated giving preference to retail and retirement funds. There is a 3% discount across the board.

The strength of this ETF lies in the specially created Index S&P BSE BHARAT-22 INDEX.

This Index is a unique blend of shares of key CPSEs, Public Sector Banks (PSBs) and also the Government owned shares in blue chip private companies like Larsen & Tubro (L&T), Axis Bank and ITC.

The shares of the Government companies represent 6 core sectors of the economy-Finance, Industry, Energy, Utilities, Fast Moving Consumer Goods (FMCG) and Basic Materials.

The index has previously out-performed the NIFTY-50 and Sensex.

The Index constituents include leading Maharatanas and Navratanas such as Coal India, GAIL, Power Grid Corporation of India Ltd. (PGCIL), National Thermal Power Corporation (NTPC), Indian Oil Corporation Ltd., Oil & Natural Gas Corporation (ONGC), Bharat Petroleum, and National Aluminium Company (NALCO), three Public Sector Banks such as SBI, Bank of Baroda apart from the 3 private sector companies mentioned earlier.

Reforms and ETF

- The Government of India is undertaking a number of Key Economic Reforms which is driving growth in these sectors of economy. The major reforms such as mentioned below for which market expert believe will fuel the growth in the economy and may benefit the underlying stocks in ETF.

- Finance: Insolvency and Bankruptcy Code 2016, Digital and Cashless Economy, Listing of Insurance companies, Bank recapitalization and Goods and Services Tax (GST).

- Commerce: Liberalization of Foreign Director Investment (FDI) in India

- Oil: Direct Benefit Transfer of LPG subsidies, Introduction of Daily Fuel pricing, Consolidation of Govt. run oil companies.

- Energy: Revival package for electricity distribution companies of India (DISCOMs).

|

▼ IBBI amends regulations to ensure due diligence [11-8-17]

Insolvency and Bankruptcy Board of India (IBBI) has amended its Corporate Insolvency Resolution Process Regulations to ensure that as part of due diligence, prior to approval of a Resolution Plan, the antecedents, credit worthiness and credibility of a Resolution Applicant, including promoters, are taken into account by the Committee of Creditors.

With a view to ensure that the Corporate Insolvency Resolution Process results in a credible and viable Resolution Plan, the Insolvency and Bankruptcy Board of India (IBBI) has carried-out amendments to the IBBI (Insolvency Resolution Process for Corporate Persons) Resolution Process, 2016 (CIRP Regulations).

The Revised Regulations make it incumbent upon the Resolution Professional to ensure that the Resolution Plan presented to the Committee of Creditors contains relevant details to assess the credibility of the Resolution Applicants.

The details to be provided would include details with respect to the Resolution Applicant in terms of convictions, disqualifications, criminal proceedings, categorization as wilful defaulter as per RBI guidelines, debarment imposed by SEBI, if any, and transaction, if any, with the Corporate Debtor in the last two years.

Apart from the above, the Resolution Professional has to also submit details in respect of transactions observed or determined, if any, covered under Section 43 (Preferential Transactions); Section 45(Undervalued Transactions); Section 50 (Extortionate Credit Transactions); Section 66 (Fraudulent Transactions) under Insolvency and Bankruptcy Code, 2016.

By virtue of the above mentioned changes in the Regulations, the Resolution Applicants, including promoters, are put to a stringent test with respect to their credit worthiness and credibility.

Further, it also imposes greater responsibility on the Resolution Professionals and the Committee of Creditors in discharging their duties.

The amendments are available at www.mca.gov.in and www.ibbi.gov.in. Insolvency and Bankruptcy Board of India (IBBI) has amended its Corporate Insolvency Resolution Process Regulations to ensure that as part of due diligence, prior to approval of a Resolution Plan, the antecedents, credit worthiness and credibility of a Resolution Applicant, including promoters, are taken into account by the Committee of Creditors.

With a view to ensure that the Corporate Insolvency Resolution Process results in a credible and viable Resolution Plan, the Insolvency and Bankruptcy Board of India (IBBI) has carried-out amendments to the IBBI (Insolvency Resolution Process for Corporate Persons) Resolution Process, 2016 (CIRP Regulations).

The Revised Regulations make it incumbent upon the Resolution Professional to ensure that the Resolution Plan presented to the Committee of Creditors contains relevant details to assess the credibility of the Resolution Applicants.

The details to be provided would include details with respect to the Resolution Applicant in terms of convictions, disqualifications, criminal proceedings, categorization as wilful defaulter as per RBI guidelines, debarment imposed by SEBI, if any, and transaction, if any, with the Corporate Debtor in the last two years.

Apart from the above, the Resolution Professional has to also submit details in respect of transactions observed or determined, if any, covered under Section 43 (Preferential Transactions); Section 45(Undervalued Transactions); Section 50 (Extortionate Credit Transactions); Section 66 (Fraudulent Transactions) under Insolvency and Bankruptcy Code, 2016.

By virtue of the above mentioned changes in the Regulations, the Resolution Applicants, including promoters, are put to a stringent test with respect to their credit worthiness and credibility.

Further, it also imposes greater responsibility on the Resolution Professionals and the Committee of Creditors in discharging their duties.

The amendments are available at www.mca.gov.in and www.ibbi.gov.in.

|

▼ First insurance cover against cybercrime in India by Bajaj Allianz [11-3-17]

For the first time, individuals can buy insurance cover against cybercrime, including loss of funds to online fraud, identity theft, cyberstalking and extortion, phishing and malware attack.

While customised cyber liability cover for businesses has been around for years, these were not over-the-counter covers that could be bought by individuals.

The Cyber Safe policy designed by Bajaj Allianz General Insurance is aimed at improving the level of comfort among individual internet and ecommerce users.

In today's digital world, the amount of personal data being generated, transmitted, and stored on to various digital devices is growing.

The critical nature of this data and the complexity of the systems that support its transmission and use have created a gamut of cyber risks.

While the policy can be purchased for a sum insured ranging from INR 1 lakh to 1 crore the company has not disclosed the premium schedule.

According to officials the rate will vary depending on the number of hours the individual spends online.

The cover is not device-specific and will cover transactions made using family devices or devices at work.

However, the policy expects the insured to not undertake transactions in cybercafes or suspect devices.

In addition to financial loss, the cover will compensate cost of legal defence if a hacker accesses the policyholder's credentials and puts out controversial comments in social media.

Besides defending the insurer, it will also provide legal costs for proceeding against the wrongdoer in cases like stalking. Those who fall prey to sophisticated phishing frauds are also protected.

The Indian cyber insurance market is valued at INR 30 crore only and comprises of protection bought by institutions.

Several credit card issuers have also provided cover against online fraud to cardholders. However, this protection is under a corporate cover purchased by the bank and is not available to individuals. For the first time, individuals can buy insurance cover against cybercrime, including loss of funds to online fraud, identity theft, cyberstalking and extortion, phishing and malware attack.

While customised cyber liability cover for businesses has been around for years, these were not over-the-counter covers that could be bought by individuals.

The Cyber Safe policy designed by Bajaj Allianz General Insurance is aimed at improving the level of comfort among individual internet and ecommerce users.

In today's digital world, the amount of personal data being generated, transmitted, and stored on to various digital devices is growing.

The critical nature of this data and the complexity of the systems that support its transmission and use have created a gamut of cyber risks.

While the policy can be purchased for a sum insured ranging from INR 1 lakh to 1 crore the company has not disclosed the premium schedule.

According to officials the rate will vary depending on the number of hours the individual spends online.

The cover is not device-specific and will cover transactions made using family devices or devices at work.

However, the policy expects the insured to not undertake transactions in cybercafes or suspect devices.

In addition to financial loss, the cover will compensate cost of legal defence if a hacker accesses the policyholder's credentials and puts out controversial comments in social media.

Besides defending the insurer, it will also provide legal costs for proceeding against the wrongdoer in cases like stalking. Those who fall prey to sophisticated phishing frauds are also protected.

The Indian cyber insurance market is valued at INR 30 crore only and comprises of protection bought by institutions.

Several credit card issuers have also provided cover against online fraud to cardholders. However, this protection is under a corporate cover purchased by the bank and is not available to individuals.

|