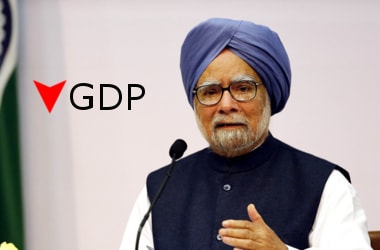

Manmohan Singh’s fear of GDP decline - True or False alarm?

Introduction:Former Prime Minister Manmohan Singh, famously trolled for his taciturn nature, recently spoke against demonetization. When he didn’t speak people sure had a problem with it and when he spoke the problem is even bigger because his speech is both trending as well as being trolled.

Out of the many other mismanagement issues of demonetization that Manmohan Singh pointed out, the foremost catch was his concern over falling GDP of the nation with the sudden and botched decision of the present government. While media and most people have given it the famous government vs. opposition turn, it shouldn’t do any harm to pay heed to the greatest fear addressed in his speech.

True1. Longer duration: Cash crunch is not something that is going to die anytime sooner. It is taking longer than necessary to revert to normalcy. All these days of severe cash crunch without any expectation on how much longer it is going to take before things get back to track will lead to further fall of GDP. The longer the cash crunch, the more negative effect it is going to have on GDP of the country.

2. Delay in consumption: With everyone being more wary of cash shortage at several places, people are naturally more conscious of how they spend their money. Majority of the people are at a disadvantage when it comes to making daily purchase. When people spend less on such a large scale, it is definitely going to have adverse effect of the nation’s GDP.

3. Wary investments: Investors are cautious of how to prevent themselves from being a victim of the cash crunch. There are anticipations that things might not work the way they were planned and hence there are far less investments in every field. The fear of losing their investments amid cash crunch is causing shift in investments.

4. Supply chain disorder: Local supply chains have suffered hugely. Grocers and market places that relied largely on cash transactions only have seen huge disruption as there are pending payments, less funds to support supply and hence less supply at places.

5. Farmers: Agriculture being the important part of our nation’s GDP is suffering hugely. Farmers are unable to manage buying of inputs for their work and hence there is delay in farming structures. They are the ones who cannot manage everything cashless. If their debts were not enough to make their lives miserable demonetization took its turn to torment them.

6. Less productivity: With half of the nation standing in queues to withdraw, deposit or exchange their own hard earned money, it is no surprise that productivity is falling and so is the GDP of the nation. Local businessmen, vendors, mason and engineers – they are all wasting a greater part of the day worrying about cash crunch.

False alarm:1. Temporary: Cash crunch is temporary. It will pass and so will the negative effects. A fall in GDP is only a short term impact as pointed out by economists who support the move. Once the new money availability stabilizes and banks are able to function normally, it will only be a matter of time when India gets its GDP back on track to once again be the one to trend higher than China’s in the medium term.

2. Positive predictions: The Central Statistics Office and the RBI have both projected a GDP growth of 7.6 percent for this fiscal. Manmohan Singh’s prediction of 2 percent fall could definitely be handled by the long term increase later and sooner if cash crunch settles down. The CSO is about to release the first advance GDP estimate on the first week of January.

3. Expected of opposition: People have faced inconvenience. They have been troubled but they are not depressed by the move. They have positive hope that it is for the greater good of the country. At this time, it was only expected that the opposition would bring forth someone like Manmohan Singh to make people deliberately see the short term negative effects and overemphasize on them.

Broking firms are lowering their GDP estimates for FY16. Either some are hailing the move to be short time and having long term benefits for the GDP or they are predicting that the negative trend will continue to FY18 as well. There will be impacts. A move as huge as this wasn’t going to come without consequences as large as to affect the GDP of the nation. To stay positive, adapt to the changes like going for the cashless options, and hoping for the silver lining in the cloud is what people need to do.